Let us now move ahead and try to understand how’s, who’s and why’s of registration under GST

Whether you should get yourself registered under GST?

Yes, if you are any one of the followings

1. If you are the supplier of goods and services and your turnover of Taxable goods and services is more than Rs. 20 Lacs

2. If you were earlier registered for the State VAT or Service tax

3. If you are Agent of a supplier & Input service distributor

4. If you are paying tax under the reverse charge mechanism

5. If you are a Person supplying via e-commerce aggregator

6. If you are e-commerce aggregator

7. If you are a Person supplying online information and database access or retrieval services from a place outside India to a person in India, other than a registered taxable person

What is the procedure for Registration?

The biggest relief for the taxpayers is that the registration for the GST is totally online and the Registration Certificate is also received online. Unlike Service Tax where the taxpayers had to get the signature from the Registration officer. This has helped in reducing the corruption at the grass root level to a large extent.

Documents for registration

Keep the following things ready for registrations

Ø PAN of the Applicant

Ø Aadhaar card

Ø Proof of business registration or Incorporation certificate

Ø Identity and Address proof of Promoters/Director with Photographs

Ø Address proof of the place of business

Ø Bank Account statement/Cancelled cheque

Ø Digital Signature

Ø Letter of Authorization/Board Resolution for Authorized Signatory

GST registration is an 11-step online process where we have to upload the required documents

Why should I get registered?

- Provide input tax credit to customers– Since your business is legally recognized, you can issue taxable invoices. Buyers, in turn, can take input credit on their purchases. This will help expand the customer base and make it more competitive.

- Take input credit– If you voluntarily register, you can take the eligible Input Tax Credit on your own purchases and input services like legal fees, consultation fees, AMC fees etc. This will eventually increase your business margin and profitability.

- Make inter-state sales without many restrictions– If you are registered under GST, you can make inter-state sales without many restrictions. Thus, it widens the potential market for SMEs. SMEs can also opt for selling their goods online through the e-commerce platform.

- Be compliant and have a good rating– Registration for GST will ensure that your business is compliant and scalable without any barrier to future registration. Also, under GST, compliance rating will be maintained and if this is done correctly, it can attract additional business.

- Better standing– A registered business will find it much easier in other business areas such as getting bank loans, renting premises.

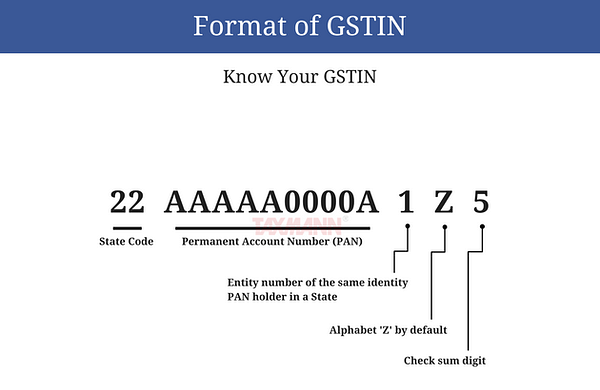

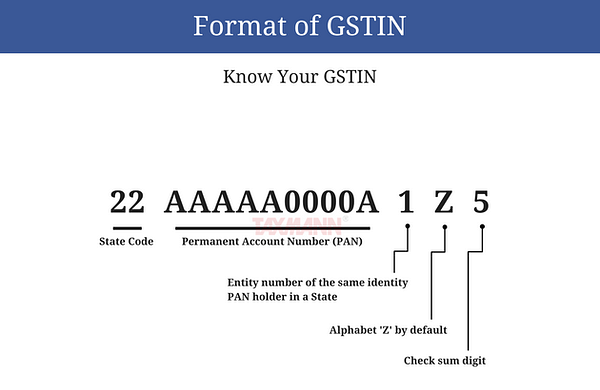

What does the GSTIN stand for?

Registration Number under GST is called GSTIN and it a is the 15-digit number, the first 2 digits are for the state code, next 10 digits PAN, 13th digit is for entity code, 14th digit is Z by default and 15th digit is checksum digit.

GST Tip: - Taxes subsumed by State Goods and Services Tax are Value

Added Tax, Entry Tax, Purchase Tax, Luxury Tax, Entertainment Tax, Octroi,

Various Surcharges & Cess's

- CA Avadhoot R Gokhale

+ 91 9850 40 6622

arg@saarvam.in

- CA Avadhoot R Gokhale

+ 91 9850 40 6622

arg@saarvam.in